YMCA OF MIDDLE TENNESSEE

2021 FINANCIAL SUMMARY

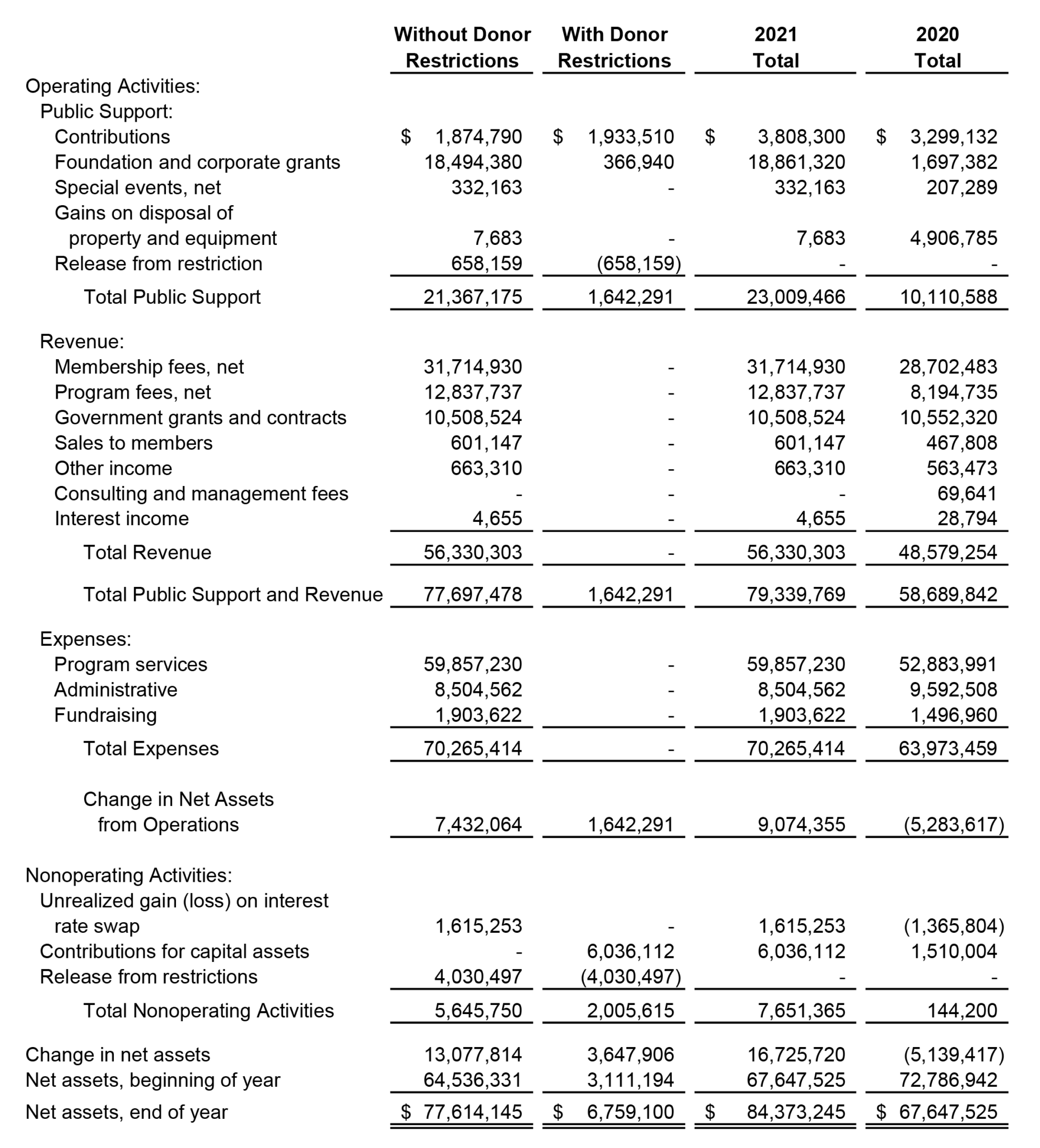

Fiscal 2021 marked a significant turnaround for our YMCA. While the COVID-19 pandemic continued to significantly impact our operations, the receipt of an unexpected $18 million gift from MacKenzie Scott’s 2020 Fund could not have arrived at a better time. 2020 was an extremely difficult year due to the pandemic, with the Association’s Net Assets declining by $5.1 million. The Scott gift enabled the Y to increase its Net Assets by $16.7 million in 2021, a turnaround of $21.8 million. The unrestricted gift further allowed us to accelerate the replenishment of our reserves and make critical investments in our facilities, outreach program sustainability, pay equity and diversity, equity and inclusion efforts, that would not otherwise have been possible in the aftermath of the Covid-19 crisis. The impact of this gift will also be realized in future fiscal years in our accordance with our plan to make these investments over a three-year period.

In addition to the Scott gift, contributions for capital assets ($6.0 million) and the unrealized gain on the value of our interest rate swap ($1.6 million) also contributed significantly toward the increase in our Net Assets.

Revenues

Revenues increased by $20.6 million over 2020, with $18 million of the improvement resulting from the previously noted Scott Gift. The increase in revenue would have been $7.5 million if the Scott gift had not been received in 2021 and the $4.9 million related to the East Nashville YCAP facility not been realized in 2020.

In addition to the Scott gift, we also received slightly more than $6 million in federal childcare grants aimed at helping providers sustain their operations throughout the pandemic and easing the financial burden on families in crisis.

Operating revenues increased by $7.7 million year-over-year, with membership fees accounting for $3.0 of the increase and program fees an additional $4.6 million.

Expenses

Total expenses increased from $64.0 million to $70.3 million, an increase of $6.3 million. As would be expected, most of the increase was in Program Services due to the increased personnel costs resulting from the hiring (and rehiring) of employees to accommodate increased utilization of our membership centers and programs.

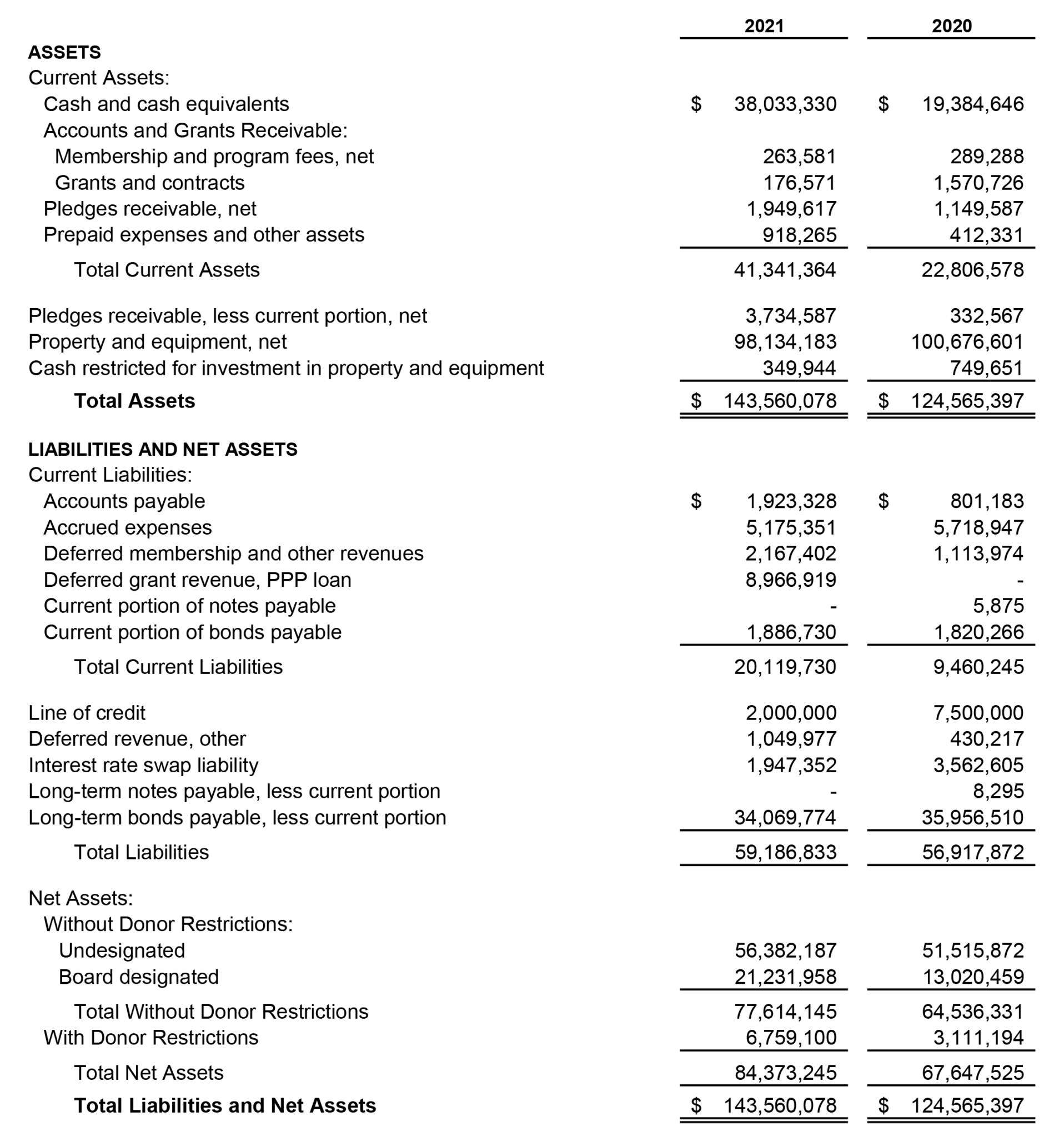

Cash/Statement of Financial Position

The culmination of the aforementioned circumstances enabled the YMCA to end 2021 with a much stronger cash balance ($38.4 million) than at the end of the previous year ($20.1 million). Cash flow from operating activities improved from ($2.4 million) to $27.1 million.

A total of $4.6 million was invested in Property and Equipment during 2021 as a result of construction projects at the Brentwood and Green Hills membership centers and the Y-CAP Davidson County location. Cash flow from investing activities in 2020 would have been ($1.4) million if the post-2020 tornado insurance settlement and sales proceeds related to the Y-CAP property were removed from the statement.

Cash flow from financing activities decreased from $7.3 million during 2020 to ($4.3 million) during 2021. The changed is mainly due to repayment of the $7.5 million we drew against our revolving line of credit during 2020 to protect our YMCA from any liquidity challenges in the financial system. We borrowed $2.0 million during 2021 to fund our operating deficit, and received $3.1 million in cash contributions to be applied to capital projects.

In closing

The tough decisions that were necessary in 2013-2015, and again in 2020, positioned us to survive the pandemic and prepare for a strong future. Our YMCA began to recuperate from the pandemic in 2020, and the combination of the Scott Gift, PPP Loan Forgiveness, and the ARPA Childcare Stabilization grants has vastly improved our financial situation.

We continue to focus on making sound long-term financial decisions while meeting the dynamic needs of a rapidly growing community. We appreciate and treasure your support as we work to fulfill our mission.

May God bless you richly!

Revenues

Revenues increased by $20.6 million over 2020, with $18 million of the improvement resulting from the previously noted Scott Gift. The increase in revenue would have been $7.5 million if the Scott gift had not been received in 2021 and the $4.9 million related to the East Nashville YCAP facility not been realized in 2020.

In addition to the Scott gift, we also received slightly more than $6 million in federal childcare grants aimed at helping providers sustain their operations throughout the pandemic and easing the financial burden on families in crisis.

Operating revenues increased by $7.7 million year-over-year, with membership fees accounting for $3.0 of the increase and program fees an additional $4.6 million.

Expenses

Total expenses increased from $64.0 million to $70.3 million, an increase of $6.3 million. As would be expected, most of the increase was in Program Services due to the increased personnel costs resulting from the hiring (and rehiring) of employees to accommodate increased utilization of our membership centers and programs.

Cash/Statement of Financial Position

The culmination of the aforementioned circumstances enabled the YMCA to end 2021 with a much stronger cash balance ($38.4 million) than at the end of the previous year ($20.1 million). Cash flow from operating activities improved from ($2.4 million) to $27.1 million.

A total of $4.6 million was invested in Property and Equipment during 2021 as a result of construction projects at the Brentwood and Green Hills membership centers and the Y-CAP Davidson County location. Cash flow from investing activities in 2020 would have been ($1.4) million if the post-2020 tornado insurance settlement and sales proceeds related to the Y-CAP property were removed from the statement.

Cash flow from financing activities decreased from $7.3 million during 2020 to ($4.3 million) during 2021. The changed is mainly due to repayment of the $7.5 million we drew against our revolving line of credit during 2020 to protect our YMCA from any liquidity challenges in the financial system. We borrowed $2.0 million during 2021 to fund our operating deficit, and received $3.1 million in cash contributions to be applied to capital projects.

In closing

The tough decisions that were necessary in 2013-2015, and again in 2020, positioned us to survive the pandemic and prepare for a strong future. Our YMCA began to recuperate from the pandemic in 2020, and the combination of the Scott Gift, PPP Loan Forgiveness, and the ARPA Childcare Stabilization grants has vastly improved our financial situation.

We continue to focus on making sound long-term financial decisions while meeting the dynamic needs of a rapidly growing community. We appreciate and treasure your support as we work to fulfill our mission.

May God bless you richly!

Read More

STATEMENTS OF FINANCIAL POSITION

DECEMBER 31, 2021 AND 2020

STATEMENT OF ACTIVITIES

YEAR ENDED DECEMBER 31, 2021

(WITH SUMMARIZED FINANCIAL DATA FOR YEAR ENDED DECEMBER 31, 2020)

STATEMENT OF ACTIVITIES

YEAR ENDED DECEMBER 31, 2020